-

Six Reasons To Review Your Estate Plan

We know that life holds many challenges today. For many of us, we do not know what the next year will look like, let alone the next month. We do not know how to best protect our families from the Coronavirus, or when things can return to “normal”. How can we plan forward when we do not know what the future holds? How can we be proactive and take steps now, even during a quarantine, to ensure that our wishes for ourselves and our loved ones can be honored?

Let us help you create some peace of mind now, during this time of uncertainty, and in the future.

Did you know an California estate plan can legally solidify your end-of-life decisions regarding your property, your investments, your legacy, and even your health care? You can decide now what you want to happen should the time come when you can no longer be in control.

An estate plan is one of the best steps forward you can take, at any time, to ensure you and your loved ones will always be protected. Remember, though, even the best-laid plans may need to be revisited and updated to reflect your wishes. When is the best time to make these revisions? This will depend on your own circumstances, or when there is a change in the law that could impact your planning.

When it comes to your circumstances, what are the changes that could necessitate you revisiting your estate planning? Let us share six of the most common events that we see in our firm that indicate a change may be needed.

- Marriage. Did you, your children or another family member named in your estate plan get married since your plan was created or last updated? Re-evaluating your estate plan can help to include new family members. When you discuss this with your estate planning attorney, together you may both determine how your will, trust, beneficiary designations, insurance policies, powers of attorney, or other important estate planning documents should or should not be amended.

- Divorce. For most married couples, a divorce also means a separation on everything and this includes estate planning. Failing to re-evaluate your estate plan after a divorce, especially after senior or “gray divorces,” could result in an ex-spouse receiving an undue inheritance or leaving you unprotected as your former spouse may no longer be recognized as a decision maker under state law.

- Taxes. Taxes are a major consideration when creating any estate plan, and tax laws are subject to change. Every state has its own laws governing estate planning and inheritance taxes. In addition, federal tax reforms, like the SECURE Act of 2019, can have a significant impact on individual estates and the markets in which estate assets are invested.

- Retirement. Retirement is a life change that often requires an estate plan re-evaluation, and it is particularly important if you have a 401(k) or an IRA. Not only were they likely established many years ago and potentially need updated beneficiary designations, but new federal legislation such as the SECURE Actof 2019, mentioned above, could greatly impact these retirement plans.

- Birth. The birth of a child or grandchild is a wonderful life event. Adding children or grandchildren to an estate plan is a great way to both protect them and provide for their future. This could include providing for their future education or creating a special needs trust, if necessary.

- Death. A death in the family may also require a re-evaluation if the deceased person was named in your estate plan. If a deceased spouse was your main beneficiary, then you will need to designate someone else as soon as possible. You may also need to update other estate planning tools such as health care documents and your durable power of attorney.

We know this article may raise more questions than it answers. If you or someone you know would like more information about re-evaluating an estate plan or creating one for the first time, do not wait to contact our law firm to meet with one of our estate planning attorneys today.

-

Gross Receipts/Business License Taxes Planning Opportunity: COVID-19 ‘Shelter in Place’ Orders

The recent weeks have brought about a series of “shelter in place” orders. San Francisco, Los Angeles, New York, and many other local jurisdictions have ordered workers to stay home. This has required an unprecedented change in work habits, with millions of employees and contractors working from home. The location of where work is performed or “out of jurisdiction payroll,” is a primary determinant of where gross receipts/business license taxes are due. As a result, certain businesses may owe less in gross receipts taxes in 2020 and future years and should consider how to account for and report out-of-jurisdiction payroll.

Gross receipts taxes are often based upon, and are required to be apportioned based upon, where the work is performed. See, e.g., L.A. Mun. Code § 21.49(c)(4); S.F. Mun. Code § 956.2; Seattle Mun. Code § 5.45.081; N.Y. Tax Law § 801; The Phila. Code § 19-2601 (definition of “Taxable Receipts”). A jurisdiction may not tax more activity than takes place within its boundaries. Container Corp. of America v. Franchise Tax Bd., 463 U. S. 159, 164 (1983); see also Allied-Signal, Inc. v. Director, Div. of Taxation, 504 U. S. 768, 777 (1992); Mobil Oil Corp. v. Commissioner of Taxes of Vt., 445 U. S. 425, 441-442 (1980). Historically, by way of example, a company with a headquarters in a metropolitan jurisdiction may typically see 85% of its work performed in that jurisdiction. As a result, 85% of the receipts of the company would be apportioned there. But often these metropolitan jurisdictions are not the same jurisdictions where the employees reside.

Companies with employees living outside the taxing jurisdiction where their offices are located should consider planning now for the impact the COVID-19 pandemic may have on their gross receipts/business license tax filings for 2020 and future years. Where there is a decline in activities occurring within the taxing jurisdiction, impacted companies will be required to apportion less revenue to the taxing jurisdiction, potentially resulting in a lower tax liability. However, some companies may experience the opposite effect (e.g., if a company is located in a jurisdiction that does not impose a business license tax but its employees are required to perform work in a jurisdiction that does impose a tax). Professional services companies, such as accounting firms, marketing companies, software developers, engineering and design firms, financial services companies, and other similar businesses may be impacted the most, among others.

Impacted companies should consider planning now for upcoming gross receipts/business license tax filings. This may include, among other things, properly documenting COVID-19’s impact on the business and tracking the location of the company’s activities throughout the year. Taking these measures now may facilitate proper tax reporting and help mitigate assessments resulting from any future audits.

-

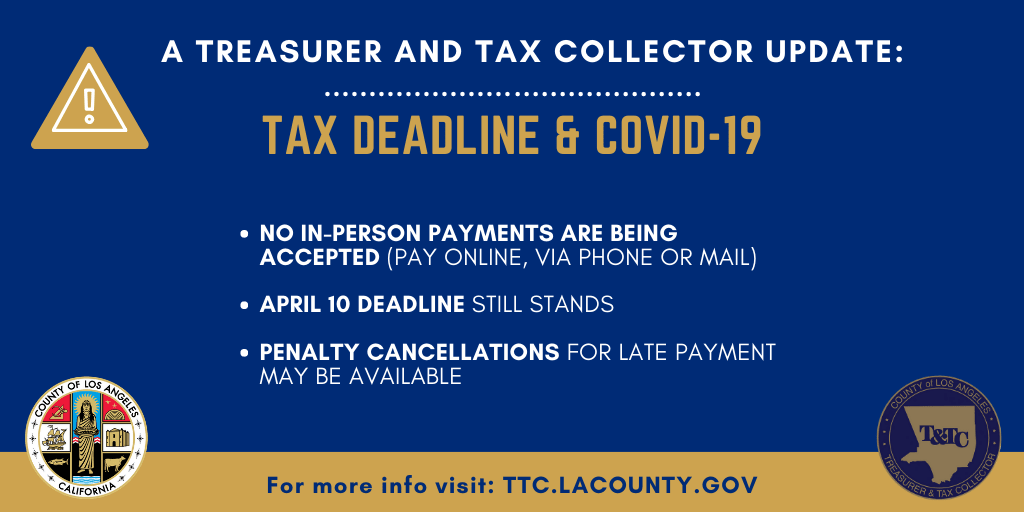

Special Notice: Property Tax Payments

Since so many people think that I collect taxes (I don’t – the Tax Collector does!),

I thought I would share information about property taxes that the

Treasurer-Tax Collector issued.

Visit the Tax Collector’s website at

https://ttc.lacounty.gov/ for more details.Statement from Keith Knox, Treasurer and Tax Collector on COVID-19 and April 10 Property Tax Deadline

Si desea obtener información adicional sobre este aviso o si necesita la información traducida en español, por favor llame al 1(213) 974-2111 entre las 8:00 a.m. y 5:00 p.m. Tiempo Pacífico, de lunes a viernes, excluyendo los días festivos del Condado de Los Ángeles.

“I understand that this is a very stressful time, especially for those suffering direct effects from this public health crisis, and my office is committed to helping in any way we can. Los Angeles County property owners affected by the COVID-19 virus may have late penalties cancelled if they are unable to pay their property taxes by the April 10 deadline.

We have no authority to extend the April 10 deadline, as outlined by State Law. However, beginning on April 11, the day after property taxes are due, people unable to pay on time for reasons related to COVID-19 may submit a request for penalty cancellation online. The department has set up a special team to process these requests for those who demonstrate they were affected by the outbreak.

We encourage all property owners who can pay their taxes on time to do so. This revenue helps keep the government running and providing vital services that the public relies on, especially in times like these.

Since County buildings are currently closed to the public during this emergency, there will be no in-person payments. Instead, taxpayers can pay online, via telephone or by mail. There is no cost for e-Check payments online. For online credit/debit card transactions, our card payment processor charges a 2.25 percent service fee.

We have developed responses to our most Frequently Asked Questions (FAQs). Please click here for our FAQs

Taxpayers can also visit https://ttc.lacounty.gov/, to review payment methods and several other online self-service options. Taxpayers may also call (213) 974-2111 for additional information”

-

Inflation-adjusted 2018 figures for various civil penalties

Inflation-adjusted 2018 figures for various civil penalties

Failure to file tax return. For 2018, the minimum penalty under Code Sec. 6651(a) for failure to timely file a tax return is $215 (up from $210 for 2017).

Failure to file certain information returns, registration statements, etc. For 2018, the following penalty amounts under Code Sec. 6652 apply.

(1) For failure to file an annual return required under Code Sec. 6033(a)(1) (for exempt organizations) or Code Sec. 6012(a)(6) (for political organizations):

(a) for an organization under Code Sec. 6652(c)(1)(A), $20 per day (same as for 2017), subject to a $10,000 maximum (same as for 2017);

(b) for an organization with gross receipts exceeding $1,048,500 (up from $1,028,500 for 2017): $100 per day (same as for 2017) subject to a $52,000 maximum (same as for 2017); for managers under Code Sec. 6652(c)(1)(B), $10 per day (same as for 2017) subject to a $5,000 maximum (same as for 2017); for public inspection of annual returns and reports under Code Sec. 6652(c)(1)(C), $20 per day (same as for 2017) subject to a $10,000 maximum (same as for 2017); and for public inspection of applications for exemption and notice of status under Code Sec. 6652(c)(1)(D), $20 per day (same as for 2017) with no maximum (same as for 2017).

(2) For failure to file a return required under Code Sec. 6034 (for certain trusts) or Code Sec. 6043(b) (relating to terminations, etc., of exempt organizations):

(a) for an organization or trust under Code Sec. 6652(c)(2)(A), $10 per day (same as for 2017) subject to a $5,000 maximum (same as for 2017);

(b) for managers under Code Sec. 6652(c)(2)(B), $10 per day (same as for 2017) subject to a $5,000 maximum (same as for 2017);

(c) for split-interest trusts under Code Sec. 6652(c)(2)(C)(ii), $20 per day (same as for 2017) subject to a $10,000 maximum (same as for 2017); and

(d) for any trust with gross receipts exceeding $262,000 (up from $257,000 for 2017) under Code Sec. 6652(c)(2)(C)(ii), $100 per day (same as for 2017) subject to a $52,000 maximum (up from $51,000 for 2017).

(3) For failure to file a disclosure required under Code Sec. 6033(a)(2):

(a) for a tax-exempt entity under Code Sec. 6652(c)(3)(A), $100 per day (same as for 2017) subject to a $52,000 maximum (up from $51,000 for 2017); and

(b) for failure to comply with written demand under Code Sec. 6652(c)(3)(B)(ii), $100 per day (same as for 2017) subject to a $10,000 maximum (same as for 2017).

Other assessable penalties with respect to the preparation of tax returns for other persons For 2018, the following penalty amounts under Code Sec. 6695 apply:

(1) For failure to furnish a copy to taxpayer under Code Sec. 6695(a), failure to sign return under Code Sec. 6695(b), failure to furnish identifying number under Code Sec. 6695(c), failure to retain a copy or list under Code Sec. 6695(d), $50 per return or claim for refund (same as for 2017) subject to a maximum penalty of $26,000 (up from $25,500 for 2017).

(2) For failure to file correct information returns under Code Sec. 6695(e), $50 per return or item in return (same as for 2017) subject to a $26,000 maximum (up from $25,500 for 2017).

(3) For negotiation of check under Code Sec. 6695(f), $520 per check with no limit (up from $510 for 2017).

(4) For failure to be diligent in determining eligibility for earned income credit under Code Sec. 6695(g), $520 per return or claim for refund with no limit (up from $510 for 2017).

Failure to file partnership return. For 2018, the dollar amount used to determine the amount of the penalty under Code Sec. 6698(b)(1) is $200 (same as for 2017).

Failure to file S corporation return. The dollar amount used to determine the amount of the penalty under Code Sec. 6699(b)(1) is $200 (same as for 2017).

Failure to file correct information returns. For 2018, the penalty amounts under Code Sec. 6721 are:

(1) For persons with average annual gross receipts for the most recent three tax years of more than $5 million, for failure to file correct information returns:

(a) under Code Sec. 6721(a)(1)’s general rule, $270 per return (up from $260 for 2017) subject to a $3,282,000 calendar year maximum (up from $3,218,500 for 2017);

(b) if corrected on or before 30 days after the required filing date under Code Sec. 6721(b)(1), $50 per return (same as for 2017) subject to a $547,000 calendar year maximum (up from $536,000 for 2017); and

(c) if corrected after the 30th day but on or before August 1 under Code Sec. 6721(b)(2), $100 per return (same as for 2017) subject to a $1,641,000 calendar year maximum (up from $1,609,000 for 2017).

(2) For persons with average gross receipts for the most recent three tax years of $5 million or less, for failure to file correct information returns:

(a) under Code Sec. 6721(d)(1)(A)’s general rule, $270 per return (up from $260 for 2017) subject to a $1,094,000 calendar year maximum (up from $1,072,000 for 2017);

(b) if corrected on or before 30 days after the required filing date under Code Sec. 6721(d)(1)(B), $50 per return (same as for 2017) subject to a $191,000 calendar year maximum (up from $187,500 for 2017); and

(c) if corrected after the 30th day but on or before August 1 under Code Sec. 6721(d)(1)(C), $100 per return (same as for 2017) subject to a $547,000 calendar year maximum (up from $536,000 for 2017).

(3) For failure to file correct information returns due to intentional disregard of the filing requirement (or the correct information reporting requirement):

(a) under Code Sec. 6721(e)(2)(A), for a return other than a return required to be filed under Code Sec. 6045(a), Code Sec. 6041A(b), Code Sec. 6050H , Code Sec. 6050I, Code Sec. 6050J, Code Sec. 6050K, Code Sec. 6050L , per-return penalty equal to the greater of $540 (up from $530 for 2017) or 10% of the aggregate amount of items required to be reported correctly with no limit;

(b) under Code Sec. 6721(e)(2)(B), for a return to be filed under Code Sec. 6045(a), Code Sec. 6050K, or Code Sec. 6050L , per-return penalty equal to the greater of $540 (up from $530 for 2017) or 5% of the aggregate amount of items required to be reported correctly with no limit;

(c) under Code Sec. 6721(e)(2)(C), for a return required to be filed under Code Sec. 6050I(a), per-return penalty equal to the greater of $27,350 or the amount of cash received up to $109,000 (up from $26,820 and $107,000 for 2017); and

(d) under Code Sec. 6721(e)(2)(D), for a return required to be filed under Code Sec. 6050V, per-return penalty equal to the greater of $540 (up from $530 for 2017) or 10% of the value of the benefit of any contract with respect to which information is required to be included on the return with no limit.

Failure to furnish correct payee statements. For 2018, the penalty amounts under Code Sec. 6722 are:

(1) For persons with average annual gross receipts for the most recent three tax years of more than $5 million:

(a) under Code Sec. 6722(a)(1)’s general rule, $270 penalty per return (up from $260 for 2017) subject to a $3,282,000 calendar year maximum (up from $3,218,500 for 2017);

(b) if corrected on or before 30 days after the required filing date under Code Sec. 6722(b)(1), $50 per return (same as for 2017) subject to a $547,000 calendar year maximum (up from $536,000 for 2017); and

(c) if corrected after the 30th day but on or before August 1 under Code Sec. 6722(b)(2), $100 per return (same as for 2017) subject to a $1,641,000 calendar year maximum (up from $1,609,000 for 2017).

(2) For persons with average annual gross receipts for the most recent three tax years of $5 million or less:

(a) under Code Sec. 6722(d)(1)(A)’s general rule, $270 per return (up from $260 for 2017) subject to a $1,094,000 calendar year maximum (up from $1,072,500 for 2017);

(b) if corrected on or before 30 days after the required filing date under Code Sec. 6722(d)(1)(B), $50 per return (same as for 2017) subject to a $191,000 calendar year maximum (up from $187,500 for 2017); and

(c) if corrected after 30th day but on or before August 1 under Code Sec. 6722(d)(1)(C), $100 per return (same as for 2017) subject to a $547,000 calendar year maximum (up from $536,000 for 2017).

(3) Where failure is due to intentional disregard of the requirement to furnish a payee statement (or the correct reporting requirement):

(a) under Code Sec. 6722(e)(2)(A), for a statement other than one required under Code Sec. 6045(b), Code Sec. 6041A (in respect of a return required under Code Sec. 6041A(b), Code Sec. 6050H(d), Code Sec. 6050J(3), Code Sec. 6050IK(b), or Code Sec. 6050L(c), per-return penalty equal to the greater of $540 (up from $530 for 2017) or 10% of the aggregate amount of items required to be reported correctly with no limit; and

(b) under Code Sec. 6722(e)(2)(B), for a payee statement required under Code Sec. 6045(b), Code Sec. 6050K(b), or Code Sec. 6050L(c), per-return penalty equal to the greater of $540 (up from $530 for 2017) or 5% of the aggregate amount of items required to be reported correctly with no limit.

-

Obvious and Subtle Signs of Elder Abuse and Neglect

If you or your loved one is in a special seeds facility (SNF), it’s important to look out for signs of abuse and neglect. Some signs are obvious, while others are very subtle.

Unfortunately, abuse and neglect can occur when SNFs try to cut corners to save money. This results in bad outcomes for the patients. SNFs become understaffed which leads to overworked employees who are frustrated with low pay and high stress, and some employees grow indifferent to the care of their patients. Additionally, by trying to save money, some SNFs will fail to purchase safety equipment like floor mats and bed alarms. All of these things equal a recipe for patient abuse and neglect.

There are laws in place to protect your loved ones from abuse and neglect, including the Elder Abuse and Dependent Adult Civil Protection Act (EADACPA), Title 22 of California Code of Regulations, policies, and procedures created by the SNF itself, and a patient’s bill of rights. However, proving abuse and neglect is a tough road. You must prove by clear and convincing evidence that the facility is guilty of something more than negligence. You’ll also need to prove the facility has been guilty of recklessness, oppression, fraud or malice in the commission of the abuse, in order to receive punitive damages.

So how is physical abuse and neglect defined? And what are the signs an SNF may be committing such acts?

Physical Abuse

The EADACPA defines physical abuse as assault, battery, assault with a deadly weapon, unreasonable physical constraint, sexual assault, and physical or chemical restraint for any purpose not authorized by the physician and surgeon

The more obvious signs of physical abuse you should look for are bruising on a loved one or other patients, especially if the bruising is frequent. You should also watch out for bone fractures. Sometimes a patient will have a broken bone and the facility won’t notice due to neglect, so keep an eye out for signs of fractures.

The more frequent type of abuse is physical or chemical restraint.

An example of physical restraint is the SNF keeps the side rails upon the patient’s bed to prevent the patient from falling off the bed at night. Unfortunately, patients will still try and get out of bed, which means they’ll climb over the rails and possibly fall to the floor. This has resulted in injury and even death. Rather than using the rails, the SNF should put floor mats on the side of the bed. However, it’s easier and cheaper for the facility to put rails up instead of purchasing a floor mat, which unfortunately increases the risk of injury to your loved one.

An example of chemical restraint is when a patient has dementia but is still a functioning individual. However the SNF doesn’t want to deal with the patient, so the patient is sedated to the point of becoming an individual who merely sits and drools.

Pay attention, communicate, and don’t let an SNF take the easy way out in its treatment of your loved one.

Neglect

The EADACPA defines neglect as either of the following: (1) The negligent failure of any person having the care or custody of an elder or a dependent adult to exercise that degree of care that a reasonable person in a like position would exercise, or (2) The negligent failure of an elder or dependent adult to exercise that degree of self-care that a reasonable person in a like position would exercise.

The most common signs of neglect you should watch out for are pressures sores and bedsores

Forms of neglect include failure to assist your loved one with personal hygiene, failure to protect your loved one from health and safety hazards, and failure to prevent malnutrition or dehydration. Another major form of neglect is the lack of supervision. When an SNF fails to supervise your loved one, the following can happen: falling, wandering and getting lost and injured, sexual assaults by other patients, fights between patients, and neglect of signs and symptoms of serious diseases. Sometimes the SNF won’t provide a patient with a shower for weeks, which can result in infections. Unfortunately, the culmination of neglect can lead to wrongful death. It’s crucial for the safety of your loved one to keep an eye out for any signs of these situations.

As mentioned earlier, winning a lawsuit against an SNF for elder abuse or neglect is a tough battle to win. The litigation periods are long, and these cases are aggressively defended by insurance carriers and counsel. However, protection of your loved one’s rights to safe treatment at a facility is paramount and facilities shouldn’t get away with any form of abuse or neglect.

If you believe your loved one is abused or neglected, contact an experienced attorney today.

-

Inflation-adjusted 2018 figures for transfer tax and foreign items

Inflation-adjusted 2018 figures for transfer tax and foreign items

Unified estate and gift tax exclusion amount. For gifts made and estates of decedents dying in 2018, the exclusion amount will be $5,600,000 (up from $5,490,000 for gifts made and estates of decedents dying in 2017).

Generation-skipping transfer (GST) tax exemption. The exemption from GST tax will be $5,600,000 for transfers in 2018 (up from $5,490,000 for transfers in 2017).

Gift tax annual exclusion. For gifts made in 2018, the gift tax annual exclusion will be $15,000 (up from $14,000 for gifts made in 2017).

Special use valuation reduction limit. For estates of decedents dying in 2018, the limit on the decrease in value that can result from the use of special valuation will be $1,140,000 (up from $1,120,000 for 2017).

Determining a 2% portion for interest on deferred estate tax. In determining the part of the estate tax that is deferred on a farm or closely-held business that is subject to interest at a rate of 2% a year, for decedents dying in 2018, the tentative tax will be computed on $1,520,000 (up from $1,490,000 for 2017) plus the applicable exclusion amount.

The increased annual exclusion for gifts to noncitizen spouses. For gifts made in 2018, the annual exclusion for gifts to noncitizen spouses will be $152,000 (up from $149,000 for 2017).

Reporting foreign gifts. If the value of the aggregate “foreign gifts” received by a U.S. person (other than an exempt Code Sec. 501(c) organization) exceeds a threshold amount, the U.S. person must report each “foreign gift” to IRS. (Code Sec. 6039F(a)) Different reporting thresholds apply for gifts received from (a) nonresident alien individuals or foreign estates, and (b) foreign partnerships or foreign corporations. For gifts from a nonresident alien individual or foreign estate, reporting is required only if the aggregate amount of gifts from that person exceeds $100,000 during the tax year. For gifts from foreign corporations and foreign partnerships, the reporting threshold amount will be $16,111 in 2018 (up from $15,797 for 2017).

Expatriation. For 2018, an individual with “average annual net income tax” of more than $165,000 (up from $162,000 for 2017) for the five tax years ending before the date of the loss of U.S. citizenship will be a covered expatriate. Under a mark-to-market deemed sale rule, all property of a covered expatriate is treated as sold on the day before the expatriation date for its fair market value. However, for 2018, the amount that would otherwise be includible in the gross income of any individual under these mark-to-market rules will be reduced by $713,000 (up from $699,000 for 2017).

Foreign earned income exclusion. The foreign earned income exclusion amount will increase to $104,100 in 2018 (up from $102,100 in 2017).

-

INTERNATIONAL TAX CHEATS BEWARE!

The United States, Canada, UK, Australia and the Netherlands have joined forces to battle international tax crimes and money laundering. The coalition J5 alliance is in response to a request from the Organization for Economic Development (OECD) for countries to take more steps to stop tax crimes. These countries will now pool their resources and expertise to conduct joint investigations.

J5’s initial priorities is to stop enablers facilitating offshore tax crimes, cybercrime and deal with the underreporting of cryptocurrencies. This group has identified offshore structures and potential tools of tax crime and money laundering. The organization has identified three key steps in its strategy:

1. Developing shared strategies to gather information and intelligence that will strengthen operational cooperation in matters of mutual interest, and target those who seek to commit transnational tax crime, cybercrime and launder the proceeds of crime

2. Driving strategies and procedures to conduct joint investigations and disrupt the activity of those who commit transnational tax crime, cybercrime, and also those who enable and assist money laundering

3. Collaborate on effective communications that reinforce that J5 is working together to tackle transnational tax crime, cybercrime and money laundering.

The J5 believes that this approach will have some outcomes, including enhancing existing investigation and intelligence programmes, identifying targets for new investigations, improving tactical intelligence, leading the wider community, and raising international awareness of the J5’s actions.

Cryptocurrency needs to be reported and there are some requirements, including filing FBARS if the cryptocurrency is located outside the United States. The American Bar Association has requested a program similar to the Offshore Disclosure Program for offshore bank accounts and the response from the Internal Revenue Service has been nil. It is imperative for holders of bitcoin and other digital currencies to make voluntary disclosures to eliminate potential criminal exposure in the future.

On Septemeber 28, 2018 the Offshore Voluntary Disclosure Program (OVDP)is ending. To come within the program you must have at a minimum submitted the first phase of documentation which typically includes forms such as 14454 and 14457. A preclearance certificate is not sufficient to enter OVDP. International tax is an enforcement priority for the IRS along with the J5. The IRS no longer needs individuals or businesses to come forward as the result of voluntary compliance from most financial institutions. Within the last five years and the information obtained under the Foreign Account Tax Compliance Act (FACTA), more than 100 countries have entered into sharing agreements with the IRS.

-

After the Enactment of the Jobs and Creation Act of 2017, Should a Taxpayer Use a C Corporation or a Pass-Through Entity to Conduct Business?

At first blush, after the enactment of the new law, the use of a C Corporation appeared to be the winner. Indeed if the C Corporation reinvests all its income back into the C Corporation and fails to make any distributions, the overall federal and state combined rate will approximate 28% in California.

Unfortunately, that is not the way most family businesses operate and the 28% rate is not reality for most businesses in California. After dividends are paid out, the business owner would be left paying up to a net closer to 50% plus in taxes, instead of the 28% rate mentioned above.

One reason to choose the C corporation would be to avoid capital gains on the sale of the business through the exclusion provided taxpayers under Section 1202. Sec. 1202 allows noncorporate taxpayers to exclude from federal income tax 100% of the gain on the sale of certain qualified small business stock (QSBS), limited to the greater of $10 million or 10 times the adjusted basis of the investment. Unlike in prior years, this creates possible opportunities for noncorporate taxpayers who dispose of QSBS in a taxable transaction to potentially exclude the entire gain for federal tax purposes.

Unfortunately, that exclusion is not easy to qualify for and the State of California has eliminated that provision for State income tax purposes.

For a taxpayer to qualify for the exclusion, five criteria generally must be met:

1. The stock must have been directly acquired via an original issuance from a U.S. C corporation (Sec. 1202(c)(1));

2. Both before and immediately after stock issuance, the C corporation’s tax basis in gross assets did not exceed $50 million (Sec. 1202(d)(1));

3. The C corporation and shareholders must consent to supply documentation regarding QSBS (Sec. 1202(d)(1)(C));

4. The C corporation conducts certain qualified active trades or businesses (Sec. 1202(e)); and

5. The stock must have been held for more than five years (Sec. 1202(b)(2)).

The other option of minimizing tax is for the owner of the stock to hold on to it until he or she dies resulting in a basis step-up. I have not had many clients tell me they are willing to wait until they die to sell the business. However, for those who are willing to allow the earnings to continue to grow under the corporation, they must or should be concerned about the personal holding company tax and the accumulated earnings tax, neither of which have been modified since 1954.

Certainly one exit strategy to consider would be to make an S election to allow the distribution of current earnings which would be subject to just one layer of income tax, at the existing marginal rates for individuals. Although the accumulated C corporation earnings can also remain in the S corporation, the owners will need to be very watchful to ensure that the passive investment income test is not breached.

Most taxpayers need and want to take distributions from their business. The most effective way to do so would be through pass-through entities, such as S Corporations, LLCs, Partnerships or Sole Proprietorships. However, if a taxpayer is merely electing one of these new entities because of new Section 199A, which allows for a 20% deduction of Qualified Business Income (“QBI”), it is important for the taxpayer to be aware that there is no guaranty that they will get that deduction.

To be eligible for a deduction under 1999A the taxpayer needs to know if it is in a qualified trade or business because the deduction is not limited to active trade or businesses. Then the taxpayer has to deal with the calculation of qualified business income. Unfortunately, there are still many undefined terms in Section 199A and then there are limits on the amount of the deduction based upon adjusted gross income or W-2 income. The only bright star is that some limitations only apply if the taxpayer’s income exceeds $157,500 for individuals or $315,000 for joint filers.

S Corp vs. Partnership

The next issue the taxpayer needs to face is whether they should elect an S corporation or a partnership. Suppose the S corporation generates $300,000 and distributes $200,000 to the owner as compensation. The S corporation would deduct the $300,000 as wages so it is left with $100,000 in QBI eligible for the pass-through deduction. However, if the partnership did not pay wages, and the partner received $300,000 and distributed its share as profits, the taxpayer would have $300,000 in QBI eligible for the pass-through deduction. There would be self-employment tax to pay and the taxpayer would have to compare the self-employment tax against the QBI deduction. Of course, it is possible that the IRS will come up with regulations that may categorize some of the partnership’s profit as wages for purposes of computing QBI.

Whether Trump’s new tax law remains in effect, is uncertain, given the political climate in Washington D.C. In 1986 we were all promised a flat tax of 28% in exchange for giving up some deductions. Some years later, it was more than 40% if you take into account the Obamacare tax. It is imperative that a taxpayer sit down with his or her legal and tax advisors to properly structure a business entity.

-

The Internal Revenue Service: Coinbase

The Internal Revenue Service has decided to limit its probe of Coinbase users to those who engaged in transactions of $20,000 or more, according to a court filing.

The IRS sent a broad request known as a John Doe summons last November seeking information on all of the San Francisco-based digital currency service’s users in an effort to ferret out possible tax evaders (see IRS seeks information on bitcoin users from Coinbase ). Coinbase is one of the largest bitcoin and ethereum exchanges in the U.S., and the Treasury Inspector General for Tax Administration urged the IRS in a report last year to do more to ensure taxpayers aren’t using virtual currencies like bitcoin to avoid taxes (see IRS warned to safeguard against illegal use of virtual currency ).

The IRS requested a federal court in March to force the exchange to hand over the records, but two Coinbase users asked the courts in May to quash the summons.

Three Republican lawmakers in Congress who chair key committees and subcommittees related to tax policy wrote a letter in May to IRS Commissioner John Koskinen expressing concerns about the scope and nature of the summons (see GOP lawmakers question IRS summons to Coinbase users ).

“We strongly question whether the IRS has actually established a reasonable basis to support the mass production of records for half of a million people, the vast majority of whom appear to not be conducting the volume of transactions needed to report them to the IRS,” House Ways and Means Committee Chairman Kevin Brady, R-Texas, Senate Finance Committee Chairman Orrin G. Hatch, R-Utah, and House Ways and Means Oversight Subcommittee Chairman Vern Buchanan, R-Fla., wrote in a letter to Koskinen. “Based on the information before us, this summons seems overly broad, extremely burdensome, and highly intrusive to a large population of individuals.”

In a court filing last week, first reported by the digital currency news site Coindesk , the IRS limited the scope of the original request. It said the U.S. is seeking information for users “with at least the equivalent of $20,000 in any one transaction type (buy, sell, send, or receive) in any one year during the 2013-15 period.”

The IRS court filing also said it is not seeking information on “certain identified users who are known to the Internal Revenue Service.” However the narrowed summons request is still asking for a great deal of information on the Coinbase users covered, including their “name, address, tax identification number, date of birth, account opening records, copies of passports and/or driver’s license, all wallet addresses, and all public keys for all accounts/wallets/vaults.”

An IRS spokesperson declined to comment based on ongoing and pending litigation.

Coinbase spokesperson Megan Hernbroth emailed Accounting Today, “We aren’t making any further comments at this stage outside of our last public statement on March 16.”

In its March statement, Coinbase said, “Our legal team is in the process of reviewing the IRS’s motion. We will continue to work with the IRS to assess the government’s willingness to fundamentally reconsider the focus and scope of the summons. If it does not, we anticipate filing opposition papers in court in coming months. We will continue to keep our customers updated as to status.”

-

Hurricane Harvey Victims: Easier Access to Retirement Funds

Hurricane Harvey Victims: Easier Access to Retirement Funds

On August 30, 2017, the IRS announced that 401(k)s and similar sponsored retirement plans can make loans and hardship distributions to victims of Hurricane Harvey and members of their families. Additionally, the IRS is also relaxing procedural and administrative rules that normally apply to retirement plan loans and hardship distributions.

With the relaxed rules, a plan may rely on the representations made by a victim as to the need for and amount of hardship distribution. The amount may not exceed the specified statutory limits from the victim’s retirement plan. However, the relief applies to any hardship of the employee, not just the types enumerated in the regulations, and no post-distribution contribution restrictions are required.

Retirement plans can provide this relief to employees and certain members of their families who live or work in disaster area localities affected by Hurricane Harvey. These areas are identified on FEMA’s website at http://www.fema.gov/disaster. If a plan makes Hurricane Harvey withdrawals available, the plan must be amended no later than the end of the first plan year beginning after December 31, 2017. Hardship withdrawals must be made by January 31, 2018.

The IRS emphasized that the tax treatment of loans and distributions remains unchanged. Ordinarily, retirement plan loan proceeds are tax-free if they are repaid over a period of five years or less. Under current law, hardship distributions are generally taxable and subject to a 10-percent early-withdrawal tax.

For further details, see Announcement 2017-11 posted on the IRS website.